Global warming is contributing to more frequent and severe natural disasters such as hurricanes, floods, wildfires, and storms. These events can cost billions of dollars in damages, leading to increased financial losses for insurance carriers. Staying one step ahead of future trends and developing proactive mitigation and pricing strategies is important for carriers to stay profitable. By using the power AI on your data, insurance carriers can turn these challenges into business opportunities.

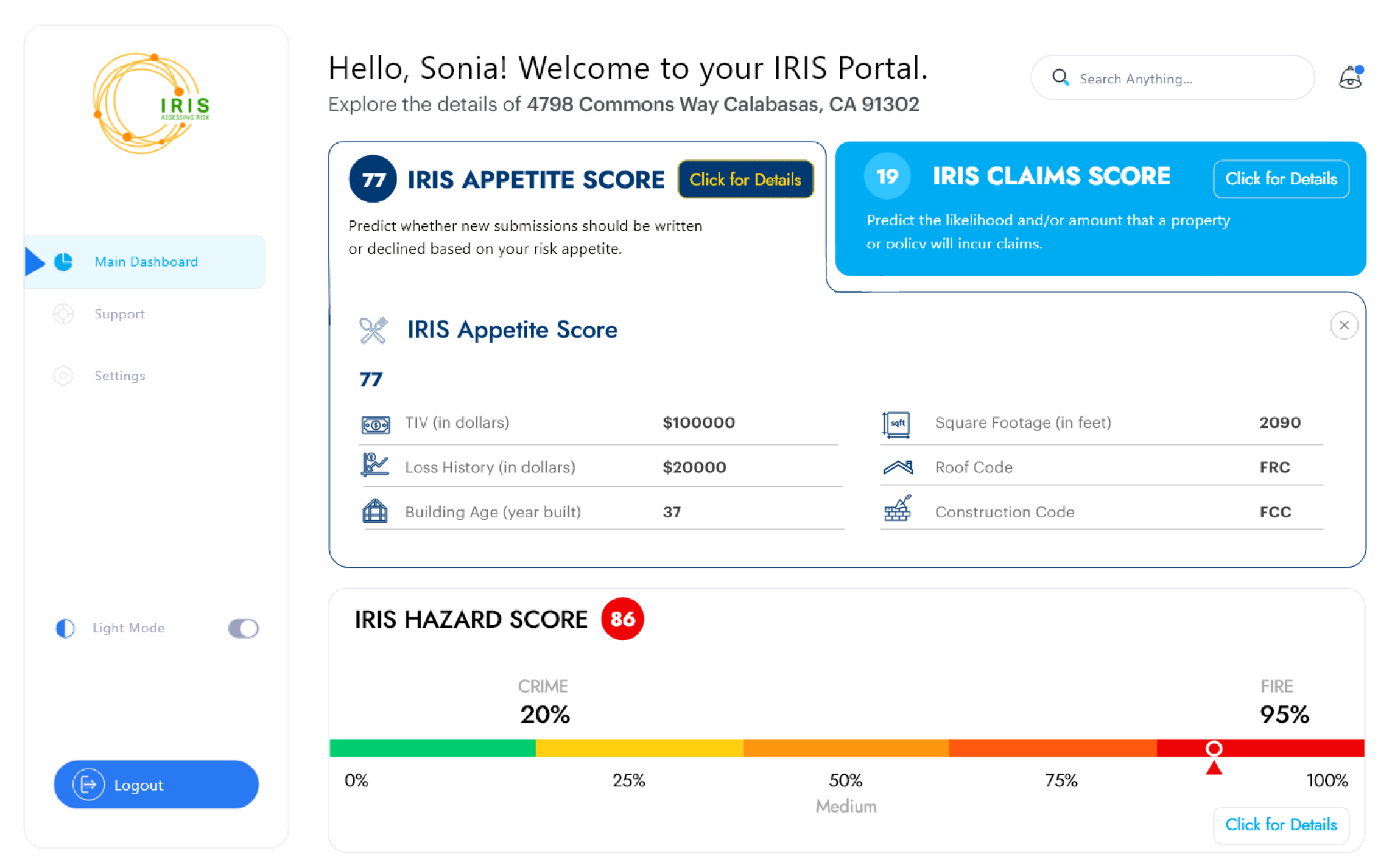

We offer a full suite of products, IRIS Solution, that enables you to assess risk precisely based on your own historical data as well as take advantage of several 3rd parties data sources. With easy-to-understand scores on a 100-point scale, you can more accurately assess the risk of individual policies.