LiRA is Aviana’s cutting-edge solution designed to revolutionize liquidity management for banks and credit unions. Leveraging advanced artificial intelligence algorithms, LiRA ensures optimal operational efficiency and control, enabling financial institutions to navigate liquidity risks with confidence.

Key Features

How LiRA Can Help

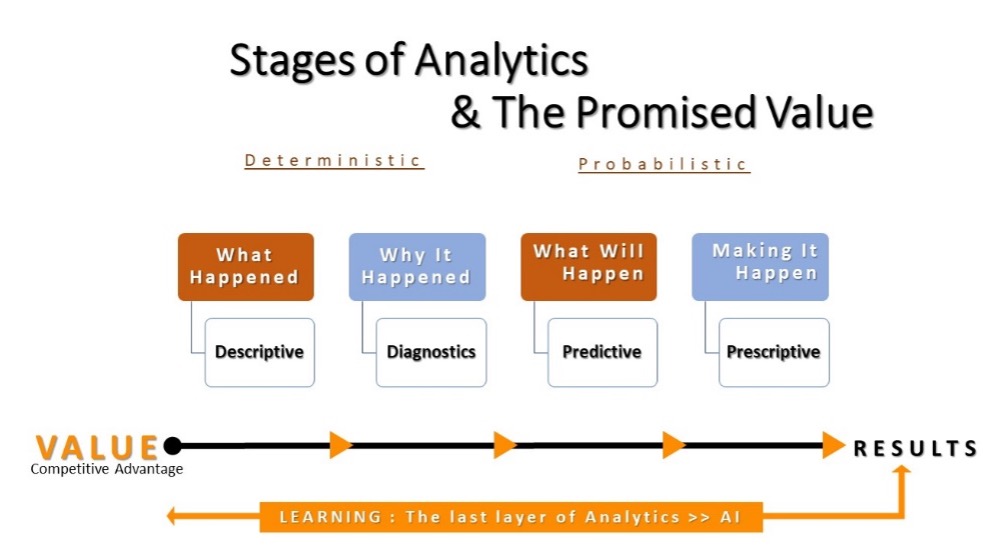

Increase Liquidity: LiRA’s predictive analytics algorithms forecast liquidity requirements accurately, enabling banks and credit unions to increase liquidity levels proactively, minimizing the risk of liquidity shortfalls.

Improve Member/Deposit Retention: LiRA’s insights enable institutions to better predict member behavior thus facilitating targeted retention strategies.

Predict Deposit Movement: LiRA utilizes sophisticated predictive modeling to forecast possible deposit movements, empowering institutions to anticipate shifts in deposit balances and allocate resources accordingly.

How LiRA Can Help

Increase Profitability: Optimizing liquidity management with LiRA can unlock new revenue streams and investment opportunities, driving profitability for banks and credit unions.

Lower Expenses: By minimizing idle cash holdings and reducing reliance on costly short-term funding sources, LiRA helps institutions lower liquidity-related expenses, contributing to overall cost efficiency.

Enhance Member Experience: LiRA enables institutions to meet profile and predict member needs promptly and effectively, strengthening relationships and loyalty.

Take Control of Your Liquidity Management with LiRA

Contact us today to learn how LiRA can transform your liquidity management practices, driving operational excellence and ensuring sustainable growth for your institution.